What Are Exoplanets And How NASA Detects Life Beyond Our Solar System

Bharti Airtel Set To Acquire Telenor India Within This Year

Google Celebrates NASA’s Discovery Of Seven Earth-Like Planets With An Animated Doodle

Some Home Remedies That Might Sound Bizarre But Actually Work Like A Charm

Akshay Kumar Feels He Has Made Enough Money, Now Wants To Focus On Content & Characters

Delhi ATM Dispenses Fake Rs 2000 Notes From ‘Childrens Bank of India’ With ‘Churan Lable’

Adolf Hitler’s Personal Telephone During World War II Is Up For Auction In The US

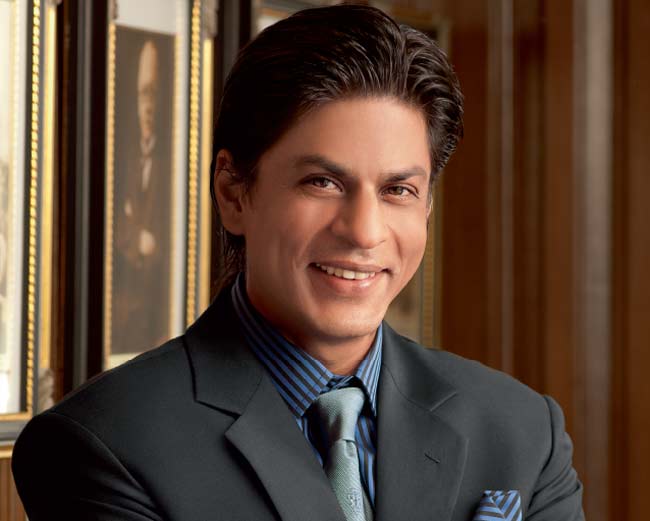

From Salman Khan To Rekha, Neil Nitin Mukesh’s Wedding Reception Was Quite A Starry Affair

How Amazon Aims To Smash Flipkart, Snapdeal This Diwali To Become No 1 In India

When Jeff Bezos donned a bandhgala jacket two years ago and posed for photographs in India, he wasn't just promoting Amazon.com Inc.'s year-old business in the country. The web retailer's chief executive officer was also putting his reputation on the line to break into the emerging e-commerce market. Now, with 80 million products for sale, 120,000-plus merchants and more than two dozen warehouses, Bezos's protégé Amit Agarwal is aiming to make Amazon the country's top online store by sales ahead of the Diwali shopping season. Known as the "festival of lights," the run-up to the celebration is India's biggest retail event, when consumers buy everything from clothes and electronics to jewelry and cars. Indians will spend as much as $1.7 billion online during Diwali this year, according to RedSeer Consulting. Flipkart Ltd., India's top web retailer, and local rival Snapdeal, are well aware that they're facing a critical test this year amid Amazon's onslaught. All three are flooding newspapers, billboards and TV shows with ads and are offering discounts for Diwali, which now makes up a third of annual e-commerce sales.

To expand inventory, Amazon has been recruiting sellers at breakneck speed. The web retailer has deployed an army of white-and-orange Chai Carts with emissaries who teach sellers how to list inventory and handle returns over cups of milky chai tea.

Another service, called Feet-on-Street, sends people on motorbikes to help merchants photograph and market their wares.

Another big task will be moving beyond India's eight big urban areas and into smaller towns and cities.

"There could be a protest on the streets, potholes on the road, labor challenges, warehouses in different regions with varied rules, goods trucks passing through state checkpoints—and after all this, the package still has to arrive at the customers’ doorstep overnight if not within hours," Agarwal said.

One key goal for Amazon—its tagline for Diwali is tyohar bade dilwala (the festival with a big heart)—is to lure dormant shoppers and first-time buyers.

There are important trends working in Amazon's favor. Exploding smartphone use offers the promise of bringing online commerce to hundreds of millions of buyers and sellers.

All of these efforts in India cost money; in June, Amazon said it will invest an additional $3 billion in India on top of an already allocated $2 billion.

"An open funding tap could help Amazon offer discounts and bleed out some of its rivals," said RedSeer's Gutgutia.

For Flipkart and Snapdeal, the upcoming Diwali season will determine their ability to stay in the game. For smaller e-commerce startups, survival is at stake.

Many, like AskmeBazaar—which advertised aggressively during Diwali last year—shut down before they could make it to this one.

Flipkart, the current market leader with more than 100 million registered users, is getting ready. Amazon's top rival in India is in advanced discussions with Wal-Mart Stores Inc. to sell a minority stake to the US retailer for as much as $1 billion.